Which of the Following Intangible Assets Is Not Amortized

As per the IFRS and US GAAP goodwill is not amortized as it is usually infinite. The intangible asset with infinite useful life should not be amortized as we cant estimate its life.

What Are Intangible Assets Double Entry Bookkeeping

Which of the following is not an example of an intangible asset.

. Perpetual franchises should not be amortized because it has an indefinite life and indefinite life intangibles are tested for impairment loss on an annual basis. Intangible assets with an indefinite life are not amortized but are assessed yearly for impairment. The most commonplace unidentifiable intangible asset is goodwill.

The perpetual franchise is a contract for a comparatively long period of time and its useful life cannot be estimated reliably. This article will break it down more how to decide on capitalizing or not capitalizing certain. McRonalds has two intangible assets.

Factors considered in determining an intangible assets useful life include all of the following except a. Internally generated goodwill is always expensed and never recorded as an asset. C recorded as an intangible asset and tested for impairment on a yearly basis.

B recorded as an intangible asset and amortized over 20 years. Intangible assets with an indefinite life should not be amortized. Consequently if an intangible asset has a useful life but can be renewed easily and without substantial cost it is considered perpetual and is not amortized.

Any legal or contractual provisions that may limit the useful life. The level of amortization should be appropriate so that the book value of an asset is not under or overstated. Is separable that s capable of being separated or divided from the entity either individually or together with a.

The amortization of an asset should only start when the asset is brought into actual use and not before even if the requisite intangible asset has been acquired. Which of the following intangible assets are not amortized. Internally generated intangible assets are initially recorded at fair value.

Annual review for impairment C. If an intangible asset has a perpetual life it is not amortized. For intangible assets subject to amortization all of the following.

The first is a patent worth 25000000 and with a useful life of 50 years. Intangible asset with indefinite life. D expensed as incurred.

Finite intangible assets are typically amortized using the straight-line method over the useful life of the asset. Any provisions for renewal or extension. Amortization of limited-life intangible assets should not be impacted by expected residual values.

Up to 24 cash back This is similar to depreciation but is credited to the intangible asset rather than to a contra account. Some intangible asset does not have limited useful life which asset will generate economic benefit into company. O o Identifiability - an intangible asset is identifiable if it either has.

IAS 38 provides general guidelines as to how intangible assets should be amortized. For tax purposes the cost basis of an intangible asset is amortized over a specific number of years regardless of the actual useful life of the asset as most intangibles dont have a. Some intangible assets are not required to be amortized every year.

However the entity must access the impairment of asset. Section 197 of the IRS tax code lists and defines the following assets as intangibles with an indefinite life assuming you created the assets as a substantial part of buying the business. The expected use of the asset.

Land is NOT an example of intangible assets. Limited-life intangibles are amortized by systematic charges to expense over their. Intangible assets which have been acquired by a.

Solution for Which of the following is an intangible asset that is not typically amortized. An intangible asset is an asset that is not physical in nature. None of these methods are correct since intangible assets are not amortized.

Intangible assets like copyrights trademarks and trade secrets have value to a business even though they dont have a physical form. A recorded as an intangible asset and not amortized. Businesses can deduct the cost of these assets as expenses over several years using a process called amortization.

Which of the following methods is commonly used to amortize intangible assets over their useful lives. The amount of any significant residual value in total and by major intangible asset class. ExplanationGoodwill refers to the intangible asset that arises when one company purchase another for a value higher than its tangible and intangible assets.

SIC 32 Intangible AssetsWeb Site Costs. Here is a detailed list of some intangible assets. Audit of Intangible Assets An intangible asset is an identifiable nonmonetary asset without physical existence or substance with has the following attributes.

The total amount assigned and the amount assigned to any major intangible asset class. Which of the following intangible assets is not amortized. Only recognized intangible assets with finite useful lives are amortized.

Accounting Amortization of Intangible Assets - IAS 38. Generally Accepted Accounting Principles the cost of this research and development must be. The weighted-average amortization period in total and by major intangible asset class.

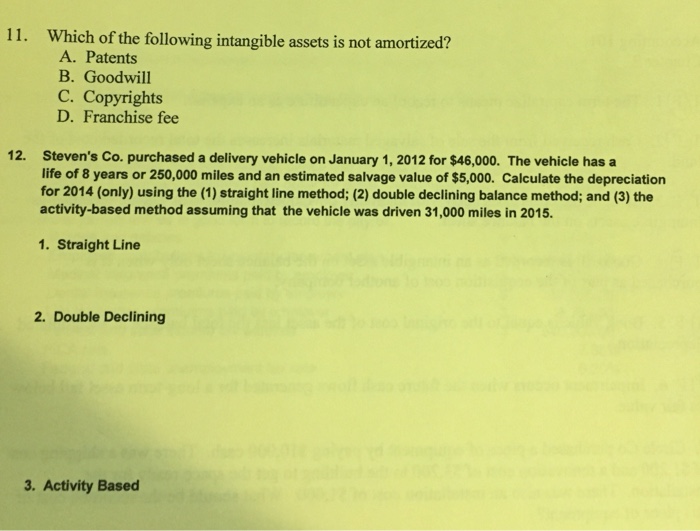

Solved 11 Which Of The Following Intangible Assets Is Not Chegg Com

How Do Intangible Assets Show On A Balance Sheet

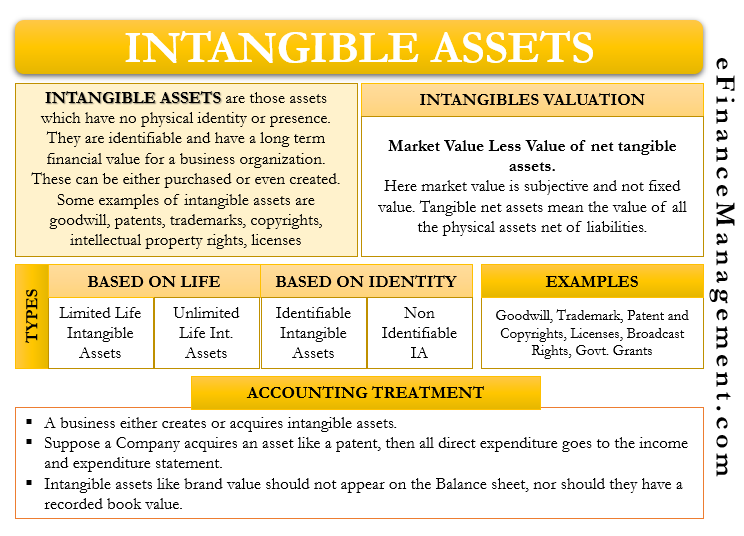

Intangible Assets Meaning Valuation Categories Example Accounting

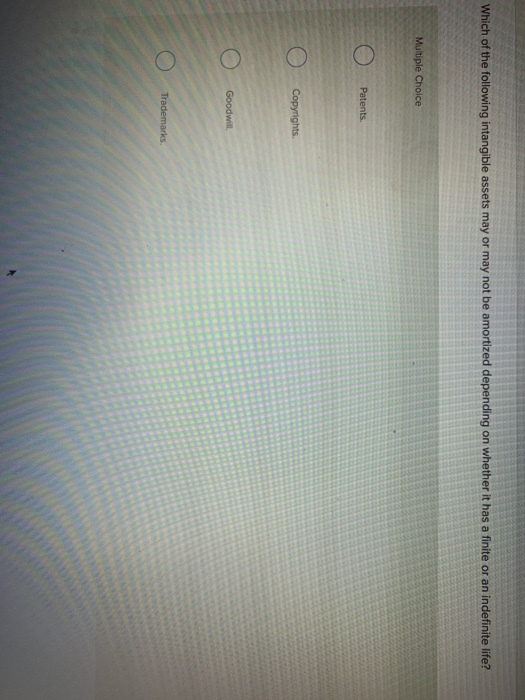

Solved Which Of The Following Intangible Assets May Or May Chegg Com

No comments for "Which of the Following Intangible Assets Is Not Amortized"

Post a Comment